Article by Quantiz partner Marcelo Krybus

Does your company have a structure dedicated exclusively to pricing? Or are pricing actions defined in a decentralized way? This article aims to show paths for strategic pricing management in your organization through a well-structured pricing area. Different structure possibilities will be commented, as well as the definition of the team to which the Pricing area should report and the sizing of the area within the company.

The evolution of the relevance of Pricing

The evolution of the importance of pricing is notorious. Currently, the largest companies in Brazil have a pricing structure, which was uncommon in the past.

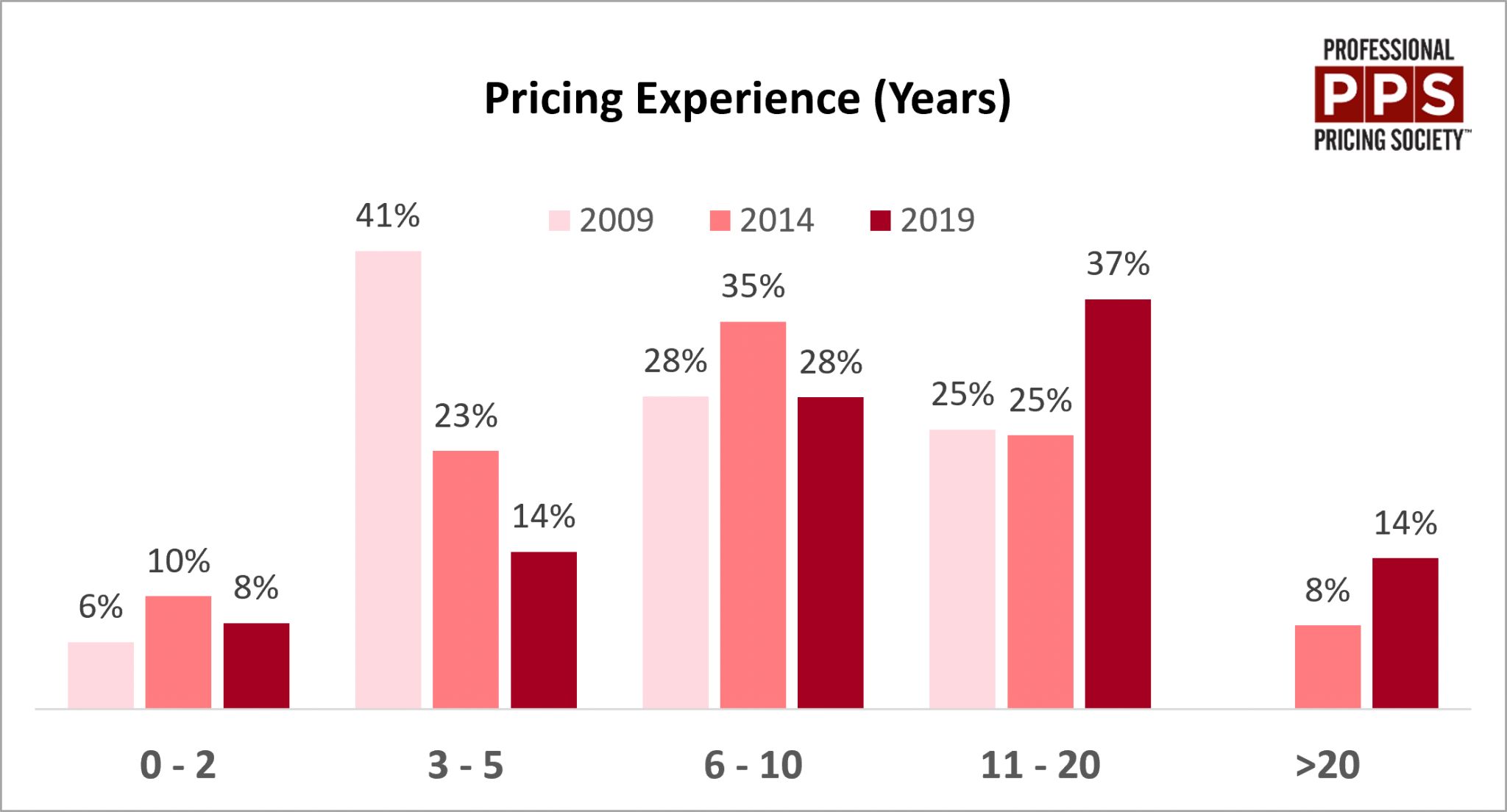

The Professional Pricing Society (PPS) conducts an annual pricing survey with professionals from various countries. One of the questions asked is about pricing experience, and from the graph below, it is possible to observe the evolution of the theme over the years.

Note that in 2009, almost 50% of respondents had up to 5 years of pricing experience. By 2019, approximately 50% of respondents had more than 11 years of experience

Source: Adapted from PPS Survey of Today’s Pricing Professional

*Note: In 2009, there was no answer for over 20 years of experience.

Although the research was not exclusively conducted in Brazil, based on the experience of Quantiz projects, considering the participation in Pricing events and also the exponential increase in followers on Quantiz’s LinkedIn page, it is possible to see that the evolution of the topic is also accelerating in Brazil.

In a 2020 survey conducted by Quantiz on the maturity level of pricing with over 120 respondents, almost 80% of companies indicated that they already had a dedicated pricing department.

Pricing structure organization

Each company has specific needs when it comes to structuring the Pricing area within their organizational chart. Each company has its own particularities, and therefore, it is not possible to recommend a single model as the ideal for structuring the Pricing area.

It is worth noting that the success of the area depends on constant interaction with stakeholders (Sales, Marketing, Finance, etc.), robust analysis, control dashboards with updated information, well-defined processes, among other important activities of the area (that will be addressed in another article).

Regarding organization, it is possible to find 3 different forms of Pricing structures:

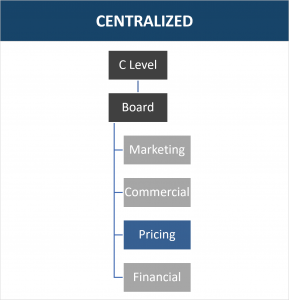

1. Centralized:

Use of a single standard management model to coordinate price decisions for the entire company.

Structure: Pricing working in parallel with other areas of the company with a leader reporting directly to the board.

Recommended for: companies with low pricing complexity, meaning a small product portfolio, few customers, and a reduced amount of negotiations/transactions.

Advantages: Greater consistency in price decisions, better adherence to established policies, and less complex price management systems.

Example: airplanes manufacturer

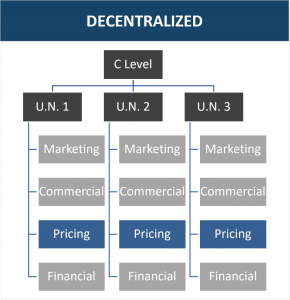

2. Decentralized:

The company does not have a standard management approach, with different systems and strategies for pricing.

Structure: Independent Pricing structure between Business Units (BU). Each BU should have its own Pricing leader, who reports directly to the BU heads.

Recommended for: Companies with high differentiation between Business Units (BUs) that do not share products or customers.

Advantages: Deeper market knowledge by the Pricing team, greater agility in pricing decisions, and processes that are better adapted to the needs of the BUs.

Example: Corporations that have little synergy between BUs.

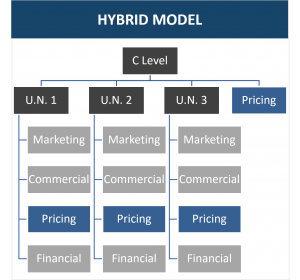

3. Hybrid:

A mixed model between centralized and decentralized structure, in which the company has a corporate direction of Pricing, but pricing decisions still remain with the business units (BU).

Structure: Corporate Pricing area supports BU’s Pricing with analysis, control and commercial policies. It also shares pricing processes and best practices. The pricing structure of each BU must conduct routine activities of each BU.

Recommended for: companies that can benefit from a corporate Pricing structure to support the business units (BUs).

Advantages: Sharing of best Pricing practices among BUs, Pricing decisions under the responsibility of each BU to consider its particularities, and standardization of content and processes in the company.

Example: Corporations that have Business Units with a lot of synergy and share customers.

To which department should Pricing report?

Another key point to be defined is to which department the Pricing area should report. Many people have this doubt and ask us about it.

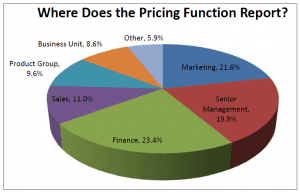

There is no standard answer. Each company has its own particularities and ends up positioning the Pricing division where it makes the most sense for its context. In the Pricing maturity level research, this information was collected. With it, it is possible to see the dispersion of the areas to which Pricing reports in companies.

Source: 2020 Pricing Maturity Level Survey – Quantiz

To most respondents, the Pricing department is below Sales (32%). During my over 10 years journey in Pricing, I have heard a few times that if Pricing is under Sales management, there would be indiscriminate discount concessions.

As stated above, this depends on each company. There are companies where the sales leadership has enough maturity to do good management and avoid price erosion, meaning the fear of Pricing being below Sales is not confirmed.

It is also worth noting that for 14% of companies, the pricing structure reports directly to the President/CEO. Some companies now have senior leadership positions, such as directors or vice presidents of Pricing, which ensures greater independence of the department. Normally, companies with this structure have a higher level of maturity in Pricing.

The 2019 PPS survey (data above) also shows a dispersion of the areas that Pricing reports to. As the survey was global, there are differences in the results compared to the Quantiz survey. One of the main differences is Sales being the area to which Pricing reports – in the PPS study, the structure is presented this way for only 11% of companies (see graph below).

This indicates the differences in contexts that we find in price management between different countries. For multinational companies, it is important to always respect the local dynamics instead of imposing strategies that work abroad.

Source: PPS December 2019 Survey of Today’s Pricing Professional

In summary, each company must reflect before making decisions:

• Which department perceives Pricing as strategic and wants to implement the area in the company?

• Does the commercial area have maturity to make strategic Pricing decisions?

• Is the financial area seen as too rigid in the company?

• Does the Marketing area get involved in discussions that involve the 4 Ps of Marketing, especially price?

Pricing Leadership

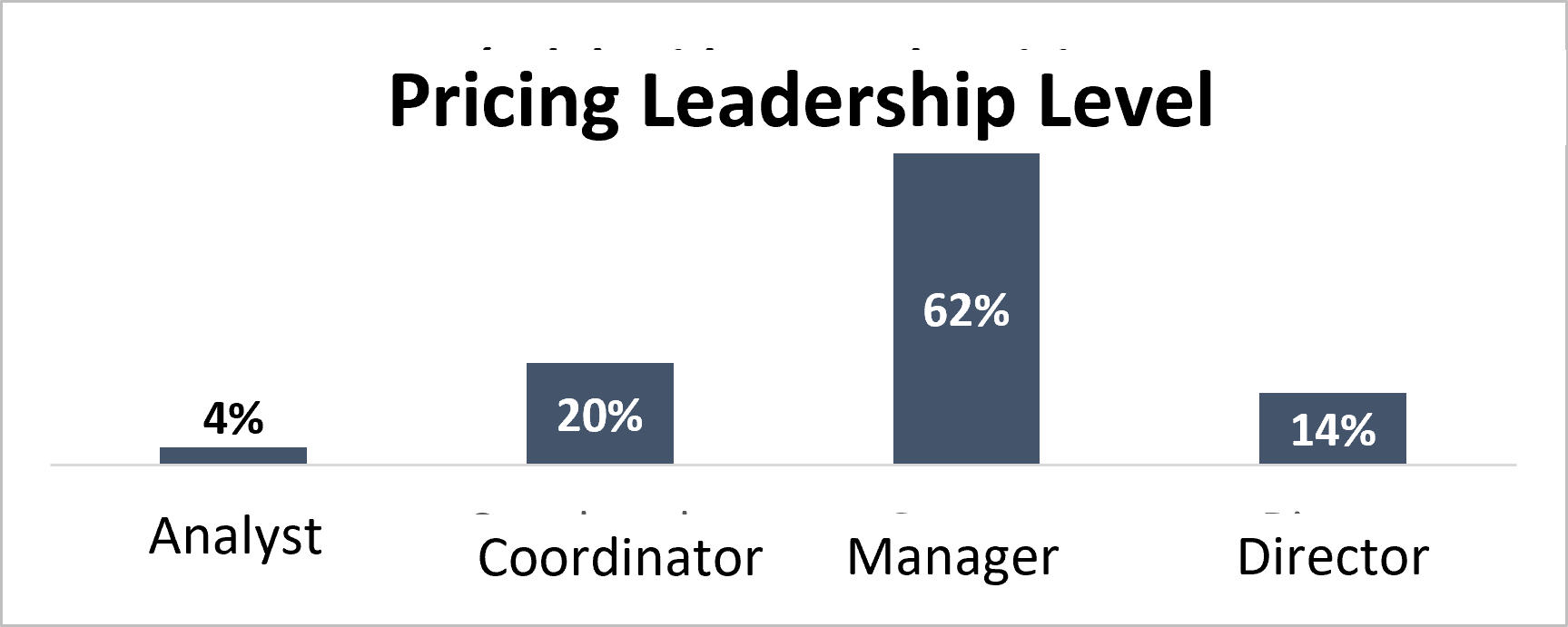

Once the structure of the area is defined, it is important to establish the position of the Pricing leader and the number of people in the area. For the Pricing leadership, we recommend at least one management position so that, in situations of conflict with other areas, the Pricing responsible can assert themselves when necessary. In the survey we conducted, the majority of companies (62%) already have a Pricing management position.

Source: 2020 Pricing Maturity Level Survey – Quantiz

Sizing the Pricing Area

Finally, it is necessary to take into account the resources required to properly conduct the area’s routines. Does the company already have a Pricing department or not? The first step is to evaluate the activities and routines before making any decisions.

In companies that do not yet have an established Pricing department, it is common to see a minimum allocation of resources until the area gains notoriety and demonstrates its value to become more robust. In some cases, we see managers taking over the area without other people reporting to them.

The company should take into consideration all the activities that the manager should perform – defining strategies, conducting analyses, engaging stakeholders, updating systems – and evaluate the overload of having only one person managing the area.

For companies that already have a department, it is recommended to evaluate the activities that make sense to maintain. For the activities that should remain, the required workload and the period in which it should be carried out should be measured, since some activities may need to be performed at the beginning or end of the month.

Once this is done, it is possible to evaluate the number of headcounts required for the area to be able to perform the tasks within the planned time. Don’t forget that, because Pricing is multidisciplinary, you should compose the area with different profiles to perform Hard Skills activities (e.g. price optimization models) and Soft Skills activities (e.g. interaction with departments during the Pricing committee).

In a recent article written by Quantiz partner Juliana Sampaio, she exposes the ideal profile for the “pricer”. (https://www.quantiz.com.br/pt/o-perfil-do-profissional-de-pricing-como-encontrar-o-seu-pricer/)

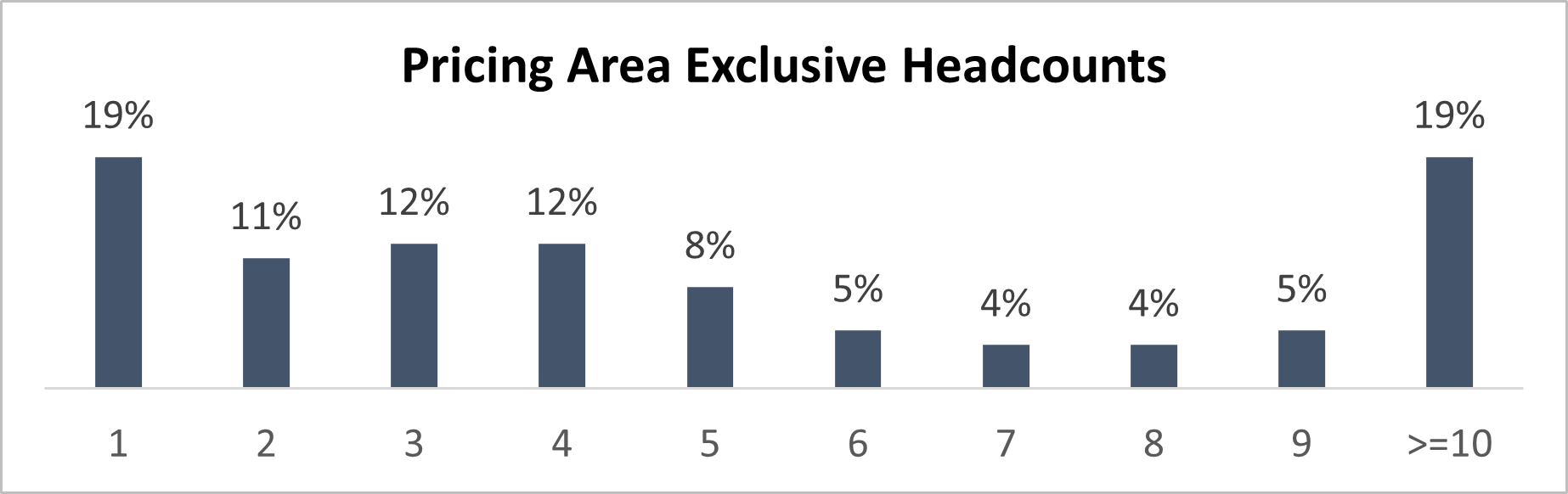

In the survey we conducted, we found a large variation in the number of people working exclusively for the Pricing area. Just over 50% of respondents stated that they have up to 4 people working exclusively in the area:

Source: 2020 Pricing Maturity Level Survey – Quantiz

Conclusion

For the success of a Pricing area, it is necessary to have support from top management for the area’s recommendations, aiming at the evolution of the area’s maturity in the company. Regardless of the structure, the area to which it reports, and the size of the area, without the support of top management, the area’s suggestions and actions are unlikely to be accepted by stakeholders and put into practice.

Another important point is to think about the development of the Pricing team. It is recommended to have a training plan on the subject to level up strategic Pricing concepts, as well as continuous learning of new concepts to improve recommendations and apply them in the area’s routine.

To advance on the Pricing journey, each company must evaluate its path. Whether with a structured area or just an allocated resource, the important thing is to assess how Pricing can help your company achieve its short and long-term objectives.

If you want to receive the research material on Pricing maturity level, just access the link: https://drive.google.com/file/d/19am6ZWdzEcjweqrlvzjBmk8jk2kF853j/view?usp=sharing