Article prepared by the partners of Quantiz, Anderson Correa and Frederico Zornig

Price Optimization – What is it?

The financial goal of any company should be to maximize its cash generation, but from a pricing management perspective, there are many variables that affect the business outcome that a Pricing and Revenue Management department does not control, such as fixed costs, capital structure, among others. Therefore, in the perspective of strategic price management, our main objective should be to maximize the contribution margin, which can also be understood as a unit incremental contribution of a product (or service) multiplied by the sales of that item. By incremental unit contribution, I understand that we are considering the revenue from each sale minus the incremental cost associated with that sale.

It is important to emphasize the incremental aspect of costs and not just a single direct variable cost per product because for each type of business, this unit cost may be different from the direct unit cost. For example, imagine

a fashion store chain that buys a collection of clothes from the industry without the possibility of return. This means that the entire batch purchased is an irrecoverable cost. In this example, the incremental cost of a sale is zero! That’s right, the merchandise is already purchased and eventually fully paid for. If I don’t sell all the pieces, those that are left over will be lost, so each piece sold does not impact my unit cost, which is already given by the purchase of the batch of clothes. Unlike a food retail store, for example, that can stock up on some seasonal product with the commitment of returning to the supplier what is not sold in a certain period, that is, a sale on consignment, to use market jargon. In this case, the incremental cost of selling one more item is the amount to be paid to the supplier for that additional product sold.

Another way to think about incremental cost is the example of selling airline tickets. In this case, the major costs are the plane itself (capital cost immobilized in the asset – the plane – or the cost of leasing the aircraft). In addition, fuel, crew, and items that will be used on board. The only relevant cost for the price decision for the incremental sale of a ticket is the cost related to this additional passenger, which may be just the value of a snack bar and a drink, for example. Therefore, understanding the cost dynamics of what you want to optimize is crucial so that you can work with the correct cost and model your optimization algorithm considering the real incremental costs of the incremental sales of your products or services.

Once the incremental cost is defined, we need to subtract it from the price at which the product will be sold to obtain the unit margin. The sum of the margins of all products sold during a specific period (day, week, month, year, etc.) is called the Absolute Contribution Margin in the currency of that period. Let us refer to it as ACM. Since our objective is to maximize the Absolute Contribution Margin (ACM), and the unit margin of a priced product p is defined as:

mu(p) = (p – c), onde mu(p) is the unit margin, c is the incremental cost, which as we saw depends on each type of business, p is the price, and D is the demand as a function of price. The optimization or maximization function of the Absolute Contribution Margin can be described as:

ACMmáx(p) = mu(p)*D(p) = (p – c)*D(p) = ap^2 + bp + c

Where a and b are coefficients that are found in the demand function D and c is a constant of adjustment

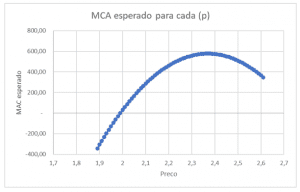

Using the equation above, we can verify that if the company prices the product at the incremental cost value, the Absolute Contribution Margin will be zero because if p = c, we have p – c = zero. As the price surpasses the incremental cost,

the unit margin increases, even with an (expected) decrease in demand (D), since now every sale generates some margin. However, as prices continue to rise, sales volume or demand (D)

tends to decrease, which provides the possibility of finding the optimal price point p that maximizes the generation of the contribution margin.

Therefore, we have to derive the function of absolute contribution margin (ACM) following the function described above:

ACM’máx(p) = 2ap + b

Soon,

p = b/2a

Implicitly, for each price level, we will have a different elasticity.

Optimization – How to Calculate the Optimal Price – Practical example

To illustrate, let’s apply the formula above using data from a project with a low-price, high-volume consumer goods product. Imagining that we have a product whose direct incremental cost is estimated at R$1.99 and its demand function is defined by the following values

D = -4000p + 11000

So the profit function is given by:

ACMmáx(p) = (p – 1,99) * (-4000p + 11000)

Doing the multiplication we have:

ACMmáx(p) = -4000p^2 + 18960p -21890

Deriving the above equation:

ACM’máx(p) = -8000p + 18960

Therefore, equating to zero and solving the equation, we have that the p that maximizes the absolute contribution margin (ACM) is:

p = 18960 / 8000 = 2,37

In words, the optimal price for the example above is R$2.37.

The figure below illustrates the equation being processed at each price level, from values below cost to values with very high margins.

Currently, seeking a price optimization solution is becoming a reality for many companies. There are several Pricing software with robust algorithms that seek to optimize prices, including not only modeling

as shown above, but also business rules to ensure limits to how far the system can change prices. In addition, with the availability of machine learning and artificial intelligence cloud technology platforms from companies such as Amazon (AWS) and Microsoft (Azure), developing your own optimization algorithm becomes a viable alternative, with the advantage of having business intelligence and not relying on a “black box” without full knowledge of the models used in optimization.

In conclusion, I emphasize that price optimization is becoming a reality for many companies that, with a high level of Pricing and Revenue Management maturity, can capture value through initiatives such as these, either through market price optimization software or proprietary price optimization algorithms. Of course, if your company does not yet have a clear pricing strategy, structured commercial policies, performance indicators, and a well-structured Pricing and Revenue Management area, it is better not to invest in such a solution yet, as I make an analogy with a house to illustrate this issue. If I do not yet have a good foundation, solid walls, doors and windows installed, and a roof to protect it all, what good will it do me to buy an automation system for curtains?

In conclusion, everything has its time and the correct moment. If the “house is in order” regarding strategic price management, then the next step may be to systematize processes and optimize prices using systems (proprietary or third-party). But if there is still a lot to be “built” in the area, it is better to prioritize activities that will ensure value capture when the time comes to develop or apply a

price optimization algorithm!