Article written by Quantiz partners – Fábio Vakuda and Tiago Martin

Artificial Intelligence, Machine Learning and Algorithms. With the advancement of technology and access to more robust information, it is increasingly common to hear these terms in our daily lives. They may often seem very complex and difficult to understand, but in reality, they can be applied in a simpler way than they appear.

The purpose of this article is to explain these main concepts, show real examples of applications in the world of Pricing and Revenue Management, benefits, challenges, and caution to consider when using these “new” technologies.

Firstly, what does each term mean?

Algorithm:

In simple terms, it is a process with several questions and answer options, a kind of decision tree, to arrive at a solution (as if there were several “if” statements in an Excel formula), which divides all possibilities of a certain action into several “paths” or answer options in a mathematical programming. Thus, the more possibilities or scenarios there are to achieve a certain goal or solution, the more complex (or with more paths) this algorithm can be.

The word “algorithm” is very old, dating back to the Middle Ages, due to the Persian Al-Khwarizmi, who developed the numerical system we still use today. More recently, in the 20th century, Alan Turing and Alonzo Church, considered the fathers of computer science, formalized the concept and defined it as “an unambiguous and ordered set of executable steps that define a finite process”.

Imagine that you want to decide what to do in your free time on a Saturday morning. If we could define some program possibilities, an algorithm could work like this:

Figure 1: Decision process used to define a Saturday schedule

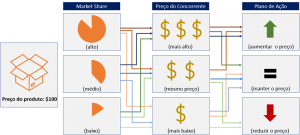

Algorithms can also be used considering a company’s business rules. For example, in a very simplified way, a decision to adjust prices based exclusively on Market Share and the prices of the main competitor could be designed as shown in Figure 2 below:

Figure 2: Decision process according to business rule based on market share and competitor’s price

Artificial Intelligence and Machine Learning:

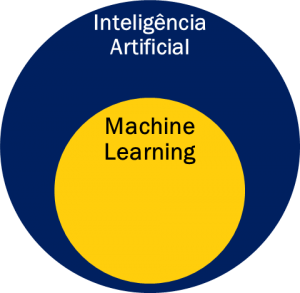

Artificial Intelligence (AI) refers to systems or machines that somehow seek to imitate human intelligence in decision-making. Machine Learning (ML) is the transformation of the decision-making process into something automatic through machines, directing decisions based on data behavior and possibly improving performance as this information accumulates, without human intervention. Therefore, it can be said that all ML is AI, but not all AI is ML. Algorithms are contained within both AI and ML.

Figure 3: Machine Learning vs Artificial Intelligence

For the reality of Pricing and Revenue Management, these concepts can be the set of rules to define product and service pricing according to established criteria that optimize, automate, and improve pricing based on the company’s strategy, historical behavior, and business rules.

In the journey of Pricing regarding AI, ML, and Algorithms, it is necessary to have a clear understanding of the desired outcome. For example, suppose the objective of a particular company is to automate the entire price adjustment process to capture more value and increase the company’s margin. In that case, it is important to ensure that the company’s strategy is clear. That is, understanding the key issues of the company and its product, such as (1) the role of each product category (destination, routine, convenience, or occasional), (2) the goal sought (profitability, market share, etc.), (3) which region should focus more on direct distribution and higher margins, and (4) in which region it is acceptable to have a lower margin and make an indirect sale through a distributor. Additionally, (5) understanding how the customer values the product attributes and their buying behavior (loyal customer, price buyer, value seeker, or convenience buyer), among other strategic business definitions.

Identifying which criteria should be taken into consideration to affect the price decision will direct how prices can be adjusted and what profitability direction is being sought. Combining this with the analysis of the sales curve of the products (items with higher turnover vs. long tail items) is a way to reach the price that meets the objective sought in each category and each product. There are a series of other possibilities for criteria, and they differ for each industry. Taking into account all of these factors mentioned, it is necessary to define which criteria can be drivers of higher or lower prices.

Another factor to consider is the business rules that direct the price management of your company. That is, in what circumstances should prices be adjusted? What triggers should be used to review product prices? Inventory? Increase/reduction in sales of a particular product? Competitor’s prices? Loss/gain of market share? Additionally, it is necessary to evaluate how dynamic the segment in which the company is located is, which will reflect on the possible frequency of price changes for products. That is, does the market allow prices to be changed several times a day, as happens with many products in e-commerce, for example? Or, as in many more traditional industries, does the market usually change prices few times during the year? The world is currently experiencing a moment of widespread inflation, and as a result, companies have increased the frequency of price adjustments, but in addition to the adjustment for inflation (cost pass-through), how frequent are price adjustments? This information is important so that it can be reflected in the logic of price changes.

Figure 4: Pricing definitions for creating algorithms

Case Study: Pricing and Revenue Management Project

In recent years, Quantiz has been developing Pricing and Revenue Management projects that use this logic to improve and provide more agility in the management of companies’ prices. To make it more tangible, let’s use an example of an auto parts company that sells to the final consumer in physical stores and, mainly, to auto repair shops. This company has over 200,000 products and serves over 100,000 customers in hundreds of stores across the country. In this scenario, price management work is extremely intense and challenging, as it can leave a lot of money on the table if opportunities for profitability are not seized or sales are lost due to mispositioned prices.

Figure 5: Automobile Parts

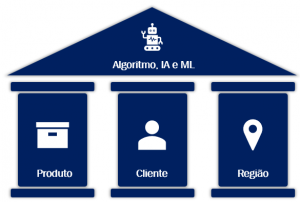

To start the algorithm’s design, we divided the price positioning criteria into 3 pillars: Product, Customer, and Region.

Figure 6: Solution Pillars (Product, Customer and Region)

Strategic Adjustments: Product

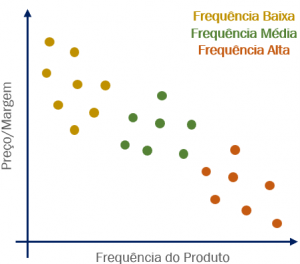

For the Product pillar, purchase frequency, product value, and price sensitivity (elasticity) were considered. Frequency: the products with the highest purchase frequency and quantity sold were more commoditized products with a higher level of competition, so pricing was more aggressive in these cases, and vice versa:

Figure 7: Frequency of Product vs. Price/Margin used

Product Price: Products with a very high or very low unit price also had higher or lower margins, respectively. The idea behind this attribute is that the more expensive products are, the more research the customer will conduct, so these products have to be competitively priced. On the other hand, very cheap products sold for pennies, when raised by a few cents, do not significantly impact the customer’s decision, so these products were priced with a higher margin.

Elasticity: The products were divided into some elasticity levels (between more elastic and less elastic) according to the result of the log-log regression between price and volume for each product: products with lower price sensitivity lead to higher margins. Note that a Supervised Machine Learning “tool” was used in the pricing algorithm to find the elasticity value (note: the elasticity topic deserves a separate article where we can discuss elasticity calculation methods, regression, treatment of outliers, etc.)

Strategic Adjustments: Customer

For this pillar, both the channel and the customers’ purchase profiles were considered.

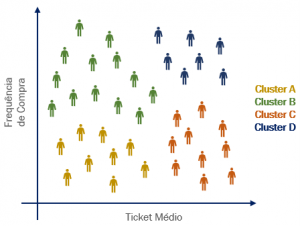

Channel: distinct positioning for the final consumer and other professional channels, such as distributors, resellers, etc. Purchase Profile: Customer segments/clusters were created according to their purchase frequency and average ticket. For example, customers who buy more products, have a higher average ticket, and have a higher frequency of sales can be considered loyal customers and get different discounts. On the other hand, customers who buy few items and purchase infrequently can be considered opportunists—they probably only buy when they can’t find the product in another competitor, and for those, we charge a higher price. Figure 8 shows an illustrative example of a 2-criteria behavior-based customer segmentation analysis using the K-means clustering method: Unsupervised Machine Learning (Note: The clustering topic also deserves an article just on the subject, there are several methods such as K-means itself, Agglomerative Hierarchical Clustering, Fuzzy C-means, etc. Each method has advantages and disadvantages, it is up to the team to evaluate which method best fits the clustering objective).

Figure 8: Customer Clustering

Looking closely at Figure 8, based on these 2 chosen criteria, there are 4 specific purchase behaviors, which can be perceived by the 4 clusters created by K-means (A: low frequency, low average ticket. B: high frequency, low average ticket C: low frequency, high average ticket, D: high frequency, high average ticket). The next step is to assess whether it makes sense to have different strategies and prices for each cluster .

Strategic Adjustments: Region

Countries with continental dimensions often have very different scenarios according to the region where the client is located, due to regional competition, different taxation, logistical complexity, and even cultural differences. Therefore, customer location was also a factor considered in the pricing algorithm. In this project, the location factor was mainly a reflection of competition around each region. The regions were classified by different levels of competitiveness and the distance from the customer vs. the main competitor (the further away the competitor was and the closer the customer was, the higher the Pricing Power would be, since delivery agility is an important factor in customers’ purchase decisions).

Tactical Adjustments

All these factors built the basis for pricing. There is also the possibility of price adjustments based on the time of sale (time of year), high or low product stock, and discount policy within the scope of the commercial team (different discounts depending on the quantity and mix sold).

Figure 9: Macro view of the solution

In this real case demonstrated, we transformed activities and decisions that were already made in a non-standardized way into a process based on structured algorithms, Artificial Intelligence and Machine Learning. As a result, the quality of decisions was maintained as planned, without relying on manual interventions, greatly reducing the possibility of human error. In addition, this allows the team to focus most of their time on discussing business strategy and direction instead of operational activities.

Final considerations

With the evolution of technology, the increase in availability of information, and growing competition, the faster we identify opportunities for improvement in decision-making and eventual business adjustments, the greater the chance of success, at the risk of losing margin capture and competitiveness in the market.

Dynamic businesses with many products, a large volume of negotiations and several possibilities for price adjustments cannot be dependent on manual operations for price management. They risk failing to capture market value and, consequently, leaving money on the table.

In structures that involve more systematization and greater automation, manual intervention is purely strategic, not operational, assessing whether it makes sense to make the adjustments signaled by algorithms and artificial intelligence. In other words, we simplify the numerous combinations between product, client, and region without disregarding the appropriate strategy for each negotiation. Consequently, there is greater capture of business value For example, the case presented allows the pricing team to manage prices with more than 20,000 possible combinations and scenarios (multiplication of all pillar possibilities) in an organized and dynamic way: all attributes become levers for the pricing team, which now has greater control over the definition of the prices, in addition to enabling a more assertive identification with structured KPIs for each pillar and attribute.

The combination of the algorithm presented with Machine Learning techniques (case examples: regressions for the calculation of elasticity and k-means for clustering customers) accompanied by structured review processes guarantees the sustainability and perpetuity of the pricing structure and constant evolution of the model.