Article written by Frederico Zornig and published in the Journal of the Professional Pricing Society (PPS).

A 2014 Forbes article from journalist Greg Petro, mentioned that Warren Buffet, CEO of Berkshire Hathaway, said “The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business.”

Buffett is talking about a very selective type of companies, those with strong enough brands and business models to capture more value out the products it is selling. By doing so, enhancing its profitability, and eventually dominating the profit share of the market.

In fact, it is common to read in textbooks and articles the following definition, or similar definitions, to pricing power: “The extent to which a company raise prices without reducing demand for its products. A company that offers a unique product or has few competitors typically has strong pricing power. It may raise prices without reducing demand.”

The definition above is the concept of price elasticity of demand, which can be calculated, in a simplistic way, by dividing the variation of quantity demanded given any variation in price.

As easy as it is this equation, it is rarely used in pricing as we know that elasticity may have many different factors that can influence it. Moreover, to have a reasonable demand curve, we must use predictive models, as some of those impacts are due to competitors’ price or supply moves and other not very stable variables.

Hence, due to its variability, we believe that elasticity is not the best metric to evaluate a company, product, or a brand pricing power. Pricing power is not something that changes with the same speed as price elasticity does. Nor it is so volatile.

Pricing power is something that takes time or money to be developed, may be years of product development, such as patented drugs or differentiated electronic devices or a new brand of a consumer product that will receive massive investment in media and distribution.

In our consulting projects, we have been developing alternatives to determine the pricing power a company, product or brand has by using other criteria. Elasticity is still one of them, but not the only one.

In fact, the most important metric, which we found the highest correlation with pricing power, is a company or brand profit share. Sometimes this information is hard to get, then we can still develop a pricing power equation using the value share of the item we are studying. So, when we do not have any information on competitive costs, which would give us the ability to estimate profit share, the value share, is the best alternative metric.

Companies can buy value share data, based on revenues, from independent sources such as Nielsen for consumer goods or other research institutes for B-to-B businesses. In the lack of an independent alternative, an ad-hoc price x volume survey from the internal sales team is usually the best solution.

Market information is also the source for the second element of our equation. We estimate the average market price of the good or service that is being analyzed to determine how many standard deviation(s) we are from the market average. Since we are talking about pricing power, it is common that our customers’ items will be above the market average. Nevertheless, you may find situations where the item is below average. This means that you do not have any pricing power.

In highly fragment, segmented and competitive markets, such as beers for an example, sometimes is useful to segment the market in low price, average price and premium price beers to compare your brand with your competitors in your segment, rather than total market.

After the definition of the average price of the market, we compare our current average prices. If the market has a high price dispersion, the standard deviation will probably be high, making it easier to capture value. On the other hand, if prices are more similar among competitors, almost like a commodity market, it becomes more difficult to receive a high standard deviation score in your brand or product limiting the opportunities to capture value. You may still have some price power, but this will come mostly from your size and volume rather than premium prices. This will also limit the capacity to have a high pricing power, as price has more impact than volume is this equation.

Elasticity, as mentioned before, is also a factor and we use it in our equation to define pricing power. Since it is not the only one, it has much less impact in the way we estimate pricing power when compared to the textbook definitions. However, as explained earlier, based on our experience, it is the most volatile factor in our model and certainly, a company or brand pricing power does not change significantly in a daily basis as elasticity can. In addition, elasticity may have different values depending if you are increasing price or decreasing it. It also depend on psychological price barriers. Pricing power may also be reduced when you lower your price, but not instantly, it may take a while before the market adjusts the value perception to your changes. In addition, it has nothing, or very little to do, with psychological price barriers.

Finally, the contribution margin generated by your product or brand is another component of our pricing power estimative. The higher the margins the higher the index you obtain. For obvious reasons, the margin you can capture in the market has high degree of correlation with pricing power as well.

In a simplified equation, we may estimate pricing power of a company, good or brand by combining indexes of profit (or value) share, contribution margins in percentage, average pricing standard deviation from average market price and elasticity. The combination of those factors provides us with a much better indication of how much pricing power your company or product has than simply measuring elasticity.

Sometimes, unfortunately, we may not be able to have all the information necessary as shown above for a more precise calculation. When we face situations that not all data is widely available or we must assume premises that may not give us reasonable confidence in the numbers to use in our model, we decide to work with another method to estimate pricing power.

We developed a more direct and simpler method to address project circumstances related to lack of proper data to estimate some of the indexes needed to complete the entire pricing power equation.

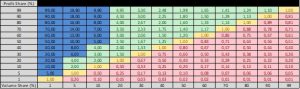

This method based on the Table 1 below is the ratio between Value Share and Volume Share, in percentages. There is an equivalent line where this ratio is one. This means that you do not have pricing power, but your competition is about at the same level as you. On the other hand, if you find yourself in the “red zone” of the table, this means that your competition has pricing power and you are probably just a pricing follower.

TABLE 1: Pricing Power Estimative – Quantiz Method 2

Better place to be, is above the equivalent line, when you can see the “green zone” with pricing power ranging from 1,1 to 4,9. This is where most companies with pricing power are. Notice that the pricing power equation is an exponential. Aligned with the concept that value is perceived exponentially, the pricing power equation also shows that your pricing power index grows exponentially.

Therefore, the aim of any differentiated company, brand or product should be to become a pricing power company with values of five or higher in our methods. Hard to achieve, but as you can imagine, highly profitable.

In conclusion, pricing power, is much more than elasticity. Other factors contribute to fully understanding of your company, brand, or product pricing power. We presented two methods widely used by Quantiz in our projects that use some of those factors to help your organization better evaluate its capacity of value capture in the market. While the first method is more complete, it is also more complex and need more data. Since, I did not detail the exponential equation in full. The second method is also viable. Even though is not as complete as our Method number one, it is certainly more accurate than elasticity as an alternative to estimate pricing power.